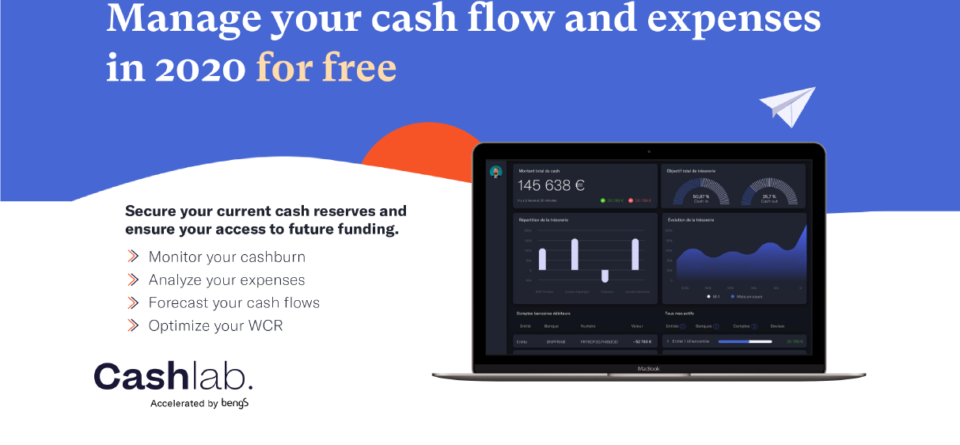

In the difficult economic climate we are experiencing, Cashlab is mobilizing to help companies and is making its solution available, free of charge*, for the year 2020.

Cash will be the major challenge for companies in 2020

In light of this, Cashlab wishes to help companies to secure their current cash reserves and access to future financing.

Through its approach, Cashlab wishes to enable companies to:

- Quickly access to a detailed view of their cash burn and expenses

- Accurately forecast future changes in their cash position.

- Assess their working capital and identify areas for improvement

- Anticipate and calibrate their financing needs

- Communicate simply to shareholders and financial partners

Cashlab maintains its operational activity during the containment period. The team remains attentive to companies’ needs in terms of working capital financing or the modelling of their medium or long-term cash flow forecasts.

*Free access is valid until the end of 2020 and concerns the following functionalities: multi-bank dashboard, short-term forecast and working capital requirement dashboard.

In a nutshell…

Cashlab, what’s that?

Cashlab is a 100% SaaS platform that offers :

- Access to all its banks on a single platform,

- A short-term cash flow forecast,

- A detailed analysis of bank flows and cash burn,

- A detailed analysis of cash and business performance indicators.

To meet which need(s)?

- Monitor and analyse in real time its cash position and cash burn,

- Identify areas for improvement and optimisation,

- Anticipate and calibrate its financing needs,

- Communicate easily with its financial partners and shareholders.

Who can register?

French companies meeting the criteria for SMEs, Start-Ups.

Investment funds wishing to provide a simple tool for their investments.

Entrepreneurial networks to facilitate the management of their members.

Number crunchers and consulting experts to support their clients.

How and where to register?

Companies wishing to benefit from this offer must register before July 1st, 2020!